What is Fractional Ownership India 2025: 7 POWERFUL Benefits Every Investor Must Know

Table of Contents

- Understanding Fractional Ownership Basics

- How Fractional Ownership Works in India

- 7 Key Benefits for Indian Investors

- Risks and Challenges

- Legal Framework and SEBI Regulations 2025

- Tax Implications in India

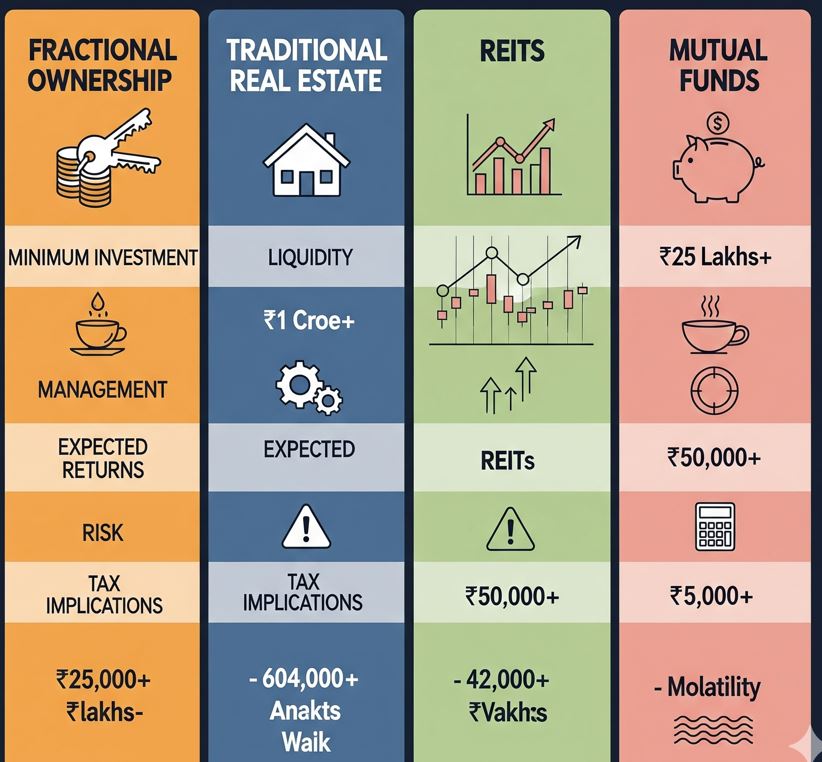

- Fractional Ownership vs Other Investments

- How to Choose the Right Platform

Introduction: The New Way Indians Invest in Property

Owning a Grade-A office in Bengaluru or a luxury villa in Goa sounds exciting. But for most of us, investing crores in a single property isn’t possible. That’s where the concept of what is fractional ownership in India comes in. It allows investors like Rohan or Priya to co-own high-value assets with others, starting from as low as ₹10–25 lakhs.

In this blog, we’ll explain what is fractional ownership in India, how it works, its benefits, risks, taxation, and the latest SEBI regulations in 2025.

Meet Rajesh, a 32-year-old IT professional from Bangalore earning ₹18 lakhs annually. He always dreamed of owning prime commercial real estate but felt frustrated watching Grade-A office buildings worth ₹50-100 crores remain out of reach. Traditional real estate seemed impossible until he discovered what is fractional ownership and how it’s revolutionizing property investment in India.

Today, Rajesh owns shares in three premium properties – an office complex in Gurgaon, a warehouse in Pune, and a co-working space in Hyderabad – with a total investment of just ₹45 lakhs. He earns ₹28,000 monthly in rental income without dealing with tenants, maintenance, or property management hassles. His story illustrates exactly what is fractional ownership and why it’s becoming India’s hottest investment trend in 2025.

But what is fractional ownership exactly, and how can it benefit you? With SEBI’s new SM REIT regulations bringing structure to this ₹5,000 crore industry, understanding what is fractional ownership has become crucial for every serious investor. Whether you’re Priya, a 28-year-old doctor with ₹20 lakhs to invest, or Arjun, a 35-year-old entrepreneur diversifying his portfolio, this guide reveals what is fractional ownership and how you can start building wealth through premium real estate from just ₹10 lakhs.

Understanding What is Fractional Ownership Basics

Before exploring the benefits and opportunities, let’s clearly define what is fractional ownership in simple terms that every investor can understand.

What is fractional ownership at its core? Imagine you and 9 friends want to buy an expensive sports car worth ₹1 crore. Instead of one person buying it completely, you each contribute ₹10 lakhs and own 10% of the car. You share the costs, benefits, and can use it based on your ownership percentage. That’s essentially what is fractional ownership – except instead of a car, you’re buying shares in premium real estate properties.

In the Indian context, what is fractional ownership means multiple investors pool money to buy high-value commercial properties like office buildings, warehouses, or retail spaces. Each investor owns a specific percentage of the property and receives proportional rental income and capital appreciation.

Key Components of What is Fractional Ownership

Legal Ownership Structure:

When you understand what is fractional ownership, you realize it’s not just buying “units” or “shares” like mutual funds. You get actual legal ownership of a portion of the physical property through a Special Purpose Vehicle (SPV) structure.

Professional Management:

Unlike traditional real estate where you handle everything yourself, what is fractional ownership includes professional property management services. Specialized companies handle tenant relations, rent collection, maintenance, and all operational aspects.

Liquidity Options:

Traditional real estate can take months or years to sell. What is fractional ownership offers relatively better liquidity through platform-based secondary markets, though it’s still less liquid than stocks or mutual funds.

According to Economic Times Real Estate Analysis, the fractional ownership market in India has grown 150% in 2024-2025, with investors increasingly understanding what is fractional ownership and its potential for wealth creation.

How What is Fractional Ownership Works in India 2025

Understanding what is fractional ownership requires knowing the step-by-step process that makes this investment model possible:

Step 1: Property Selection and Due Diligence

Fractional ownership platforms identify high-quality commercial properties with strong rental yields and appreciation potential. When you understand what is fractional ownership, you realize these aren’t random properties but carefully vetted Grade-A assets.

Typical Property Criteria:

- Prime locations in Tier-1 cities (Mumbai, Delhi, Bangalore, Pune)

- Established tenants with long-term lease agreements

- Rental yields of 7-11% annually

- Properties worth ₹25 crores to ₹200 crores

Step 2: Property Fractionalization

Once selected, the property is divided into shares, typically ranging from 0.25% to 5% per investor. This is the practical application of what is fractional ownership – making expensive properties accessible to multiple investors.

Investment Example:

- Property Value: ₹100 crores

- Minimum Investment: ₹25 lakhs (0.25% ownership)

- Maximum Investment: ₹5 crores (5% ownership)

- Total Investors: 20-400 people

Step 3: Legal Structure Creation

A Special Purpose Vehicle (SPV) is created to hold the property legally. This SPV structure is crucial to what is fractional ownership as it provides clear legal ownership rights to each investor.

Step 4: Investment and Ownership

Investors purchase their desired ownership percentage and receive legal documentation proving their ownership stake. This is where what is fractional ownership becomes real – you’re not just investing, you’re becoming a property owner.

Step 5: Professional Management

The platform manages the property professionally, handling all operational aspects. Monthly rental income is distributed proportionally to all investors based on their ownership percentage.

7 Key Benefits: Why What is Fractional Ownership is Revolutionizing Indian Real Estate

Understanding what is fractional ownership is incomplete without knowing its compelling benefits for Indian investors:

Benefit 1: Dramatically Lower Entry Barriers

The primary advantage of what is fractional ownership is accessing premium real estate with significantly lower capital requirements.

Traditional vs Fractional Investment:

- Traditional: ₹50 crores needed for entire Grade-A office building

- Fractional: ₹10-50 lakhs for ownership stake in same building

- Difference: 100x-500x lower capital requirement

This democratization is the essence of what is fractional ownership – making institutional-grade real estate accessible to retail investors.

Benefit 2: Portfolio Diversification Across Properties

What is fractional ownership allows spreading investment across multiple properties and locations, reducing concentration risk.

Diversification Example (₹1 Crore Investment):

- 40% in Bangalore office complex (₹40 lakhs)

- 35% in Mumbai warehouse facility (₹35 lakhs)

- 25% in Pune co-working space (₹25 lakhs)

This diversification, impossible in traditional real estate, showcases why understanding what is fractional ownership is crucial for modern investors.

Benefit 3: Professional Property Management

What is fractional ownership eliminates the biggest pain point of real estate investing – property management hassles.

Management Services Included:

- Tenant screening and lease negotiations

- Rent collection and distribution

- Property maintenance and repairs

- Legal compliance and documentation

- Performance reporting and updates

Benefit 4: Higher Rental Yields

Grade-A commercial properties typically offer better rental yields than residential properties, making what is fractional ownership more attractive for income-focused investors.

Rental Yield Comparison:

- Residential Properties: 2-4% annual rental yield

- Commercial Properties (Fractional): 7-11% annual rental yield

- Advantage: 2-3x higher rental income potential

Benefit 5: Institutional-Grade Property Access

What is fractional ownership provides access to properties typically reserved for large institutions and ultra-wealthy individuals.

Property Types Available:

- Multi-tenant office complexes

- Logistics and warehouse facilities

- Data centers and co-location facilities

- Hotels and hospitality assets

- Retail and commercial complexes

Benefit 6: Transparency and Regular Updates

Unlike traditional real estate investments, what is fractional ownership platforms provide regular updates, financial reports, and property performance metrics.

Transparency Features:

- Monthly rental income statements

- Quarterly property performance reports

- Annual property valuations

- Market analysis and trends

- Exit opportunity updates

Benefit 7: Better Liquidity Options

While not as liquid as stocks, what is fractional ownership offers better exit options compared to traditional real estate.

Liquidity Features:

- Platform-based secondary markets

- Periodic buyback programs by platforms

- Faster transaction processing (30-90 days vs 6-12 months)

- Professional valuation services

Risks and Challenges: The Complete Truth About What is Fractional Ownership

Understanding what is fractional ownership requires honest discussion about potential risks and challenges:

Market and Property-Specific Risks

What is fractional ownership involves real estate market exposure, which includes:

Property Value Fluctuations:

- Commercial real estate values can decline during economic downturns

- Location-specific risks (infrastructure changes, zoning modifications)

- Tenant default or vacancy risks affecting rental income

Market Cycle Risks:

- Real estate operates in cycles typically lasting 7-12 years

- Interest rate changes affecting property valuations

- Economic conditions impacting tenant demand

Platform and Operational Risks

Since what is fractional ownership depends on platform operations, consider these risks:

Platform Stability:

- Business continuity of fractional ownership platforms

- Quality of property management services

- Technology platform reliability and security

Regulatory Changes: With SEBI introducing SM REIT regulations, existing platforms must adapt their structures, potentially affecting existing investments.

Liquidity Limitations

Despite better liquidity than traditional real estate, what is fractional ownership still has constraints:

Exit Challenges:

- Secondary market may lack buyers during market downturns

- Pricing discovery can be challenging for unique properties

- Exit timelines still longer than public market investments

Legal Framework and SEBI Regulations 2025: What is Fractional Ownership Compliance

The regulatory landscape around what is fractional ownership has evolved significantly in 2025, providing greater investor protection and industry structure.

SEBI’s SM REIT Framework

SEBI has introduced Small and Medium REITs (SM REITs) to regulate fractional ownership platforms, fundamentally changing what is fractional ownership looks like legally.

Key SM REIT Requirements:

- Minimum Pool Size: ₹50 crores with at least 200 investors

- Registration Requirement: All platforms must register as SM REITs

- Structural Compliance: Separate entities for trustee, sponsor, and investment manager

- Disclosure Standards: Enhanced transparency and reporting requirements

Legal Ownership Structure

Understanding what is fractional ownership legally involves several key components:

Special Purpose Vehicle (SPV):

- Each property owned through a separate legal entity

- Investors hold shares in the SPV, not direct property ownership

- Clear legal title and ownership rights established

Documentation and Rights:

- Shareholders’ agreement defining rights and obligations

- Property management agreements

- Exit mechanisms and procedures

Investor Protection Measures

The new regulations enhance what what is fractional ownership means for investor safety:

Enhanced Oversight:

- SEBI supervision of platform operations

- Standardized disclosure requirements

- Regular audit and compliance monitoring

Operational Standards:

- Professional property management requirements

- Transparent fee structures and reporting

- Clear exit policies and procedures

According to Livemint’s SEBI Analysis, these regulatory changes make what is fractional ownership a more structured and safer investment option for retail investors.

Tax Implications: Understanding What is Fractional Ownership from Tax Perspective

Tax treatment is crucial when considering what is fractional ownership as an investment option in India:

Rental Income Taxation

What is fractional ownership generates two types of income, each taxed differently:

Rental Income Treatment:

- Taxed as “Income from House Property”

- 30% standard deduction allowed on rental income

- Additional deductions for interest on loans (if applicable)

- Taxed at marginal tax rate based on total income

Example Calculation:

- Annual rental income: ₹3,00,000

- Less: Standard deduction (30%): ₹90,000

- Taxable rental income: ₹2,10,000

- Tax liability: Based on individual’s tax slab

Capital Gains Taxation

When you sell your fractional ownership stake, what is fractional ownership profits are treated as capital gains:

Short-term Capital Gains (Held < 24 months):

- Taxed at marginal tax rate

- No indexation benefit available

Long-term Capital Gains (Held ≥ 24 months):

- Taxed at 20% with indexation benefit

- Cost inflation index applied to purchase price

Tax Planning Strategies

Optimizing what is fractional ownership tax impact:

Timing Strategies:

- Hold investments for over 24 months to qualify for LTCG treatment

- Plan exits to optimize tax liability across financial years

Documentation Requirements:

- Maintain detailed records of purchase price and expenses

- Track rental income and TDS certificates

- Document property-related expenses for deductions

What is Fractional Ownership vs Other Investment Options

Understanding what is fractional ownership requires comparing it with alternative investment options available to Indian investors:

Fractional Ownership vs REITs

This is the most common confusion about what is fractional ownership:

| Aspect | Fractional Ownership | REITs |

|---|---|---|

| Ownership Type | Direct ownership in specific property | Units in trust holding multiple properties |

| Minimum Investment | ₹10-50 lakhs | ₹10,000-15,000 |

| Liquidity | Platform-based secondary market | Stock exchange trading |

| Property Selection | Choose specific properties | Trust manager decides |

| Rental Income | Direct from owned property | Dividend from trust |

Fractional Ownership vs Traditional Real Estate

What is fractional ownership offers several advantages over traditional property investment:

Capital Requirements:

- Traditional: ₹1-5 crores for Grade-A commercial property

- Fractional: ₹10-50 lakhs for similar property exposure

Management Effort:

- Traditional: Full responsibility for tenant management

- Fractional: Professional management included

Diversification:

- Traditional: Single property concentration risk

- Fractional: Multiple properties across locations

Fractional Ownership vs Equity Mutual Funds

What is fractional ownership serves a different purpose compared to equity investing:

Return Characteristics:

- Fractional Ownership: Steady rental income + capital appreciation

- Equity Funds: Growth-focused with higher volatility

Risk Profile:

- Fractional Ownership: Real estate market correlation

- Equity Funds: Stock market correlation

Time Horizon:

- Fractional Ownership: Medium to long-term (5+ years)

- Equity Funds: Flexible based on fund type

How to Choose the Right Platform: What is Fractional Ownership Selection Criteria

Selecting the right platform is crucial when investing in what is fractional ownership. Here’s a comprehensive evaluation framework:

Platform Credibility Assessment

When evaluating what is fractional ownership platforms, consider:

Track Record and Experience:

- Years of operation in fractional ownership space

- Total assets under management (AUM)

- Number of successful property exits

- Investor base size and retention

Leadership and Team:

- Management team background and experience

- Real estate industry expertise

- Technology and operations capabilities

Property Selection and Due Diligence

Quality of properties determines what is fractional ownership success:

Property Evaluation Criteria:

- Location analysis and growth prospects

- Tenant quality and lease terms

- Property condition and maintenance history

- Market rental rates and yield potential

Due Diligence Process:

- Legal title verification procedures

- Property valuation methodology

- Market analysis and comparison

- Risk assessment and mitigation

Fee Structure and Transparency

Understanding what is fractional ownership costs is essential:

Typical Fee Structure:

- Platform fees: 2-5% of transaction value

- Management fees: 5-12% of rental income

- Exit fees: 2-3% of sale proceeds

- Other charges: Legal, registration, maintenance

Transparency Requirements:

- Clear fee disclosure before investment

- Regular financial reporting

- Property performance updates

- Market valuation reports

Technology and User Experience

Modern what is fractional ownership platforms should offer:

Digital Features:

- User-friendly investment dashboard

- Real-time portfolio tracking

- Document management system

- Customer support quality

Regulatory Compliance

With new SEBI regulations, ensure platforms comply with SM REIT requirements:

Compliance Checklist:

- SEBI registration status

- Proper legal structure implementation

- Disclosure standard adherence

- Investor protection measures

Leading Platforms for Reference: While not endorsing specific platforms, research these established players to understand what is fractional ownership standards:

- PropShare

- Strata

- hBits

- IndiAssetz

- Grip Invest

Future Outlook: What is Fractional Ownership Evolution in India

The future of what is fractional ownership in India looks promising based on several positive trends:

Market Growth Projections

What is fractional ownership is expected to grow exponentially:

Market Size Estimates:

- 2024: ₹5,000 crores market size

- 2027: Projected ₹15,000+ crores market

- Growth rate: 35-40% annually

Regulatory Maturation

SEBI’s SM REIT framework will standardize what is fractional ownership operations, increasing institutional investor confidence and retail participation.

Technology Integration

What is fractional ownership platforms are incorporating:

- AI-powered property selection

- Blockchain for transparent ownership records

- IoT for property monitoring

- Advanced analytics for performance tracking

Asset Class Expansion

Beyond traditional commercial real estate, what is fractional ownership is expanding to:

- Student housing projects

- Senior living facilities

- Healthcare real estate

- Industrial and logistics assets

- International property exposure

FAQs: Complete Guide to What is Fractional Ownership

1. Q: What is fractional ownership and is it legal in India? A: What is fractional ownership refers to multiple investors jointly owning shares in high-value real estate properties. Yes, it’s completely legal in India, and SEBI has introduced SM REIT regulations in 2025 to provide better structure and investor protection.

2. Q: What is fractional ownership minimum investment amount in India? A: What is fractional ownership typically requires minimum investments ranging from ₹10 lakhs to ₹50 lakhs, depending on the property and platform. This is significantly lower than traditional commercial real estate investments.

3. Q: What is fractional ownership typical return expectation? A: What is fractional ownership in Grade-A commercial properties typically generates 7-11% annual rental yields plus potential capital appreciation of 6-10% annually, resulting in total returns of 13-21% per year historically.

4. Q: What is fractional ownership tax treatment compared to direct property investment? A: What is fractional ownership follows similar tax treatment – rental income taxed as “Income from House Property” with 30% standard deduction, and capital gains taxed based on holding period (20% LTCG with indexation for >24 months).

5. Q: What is fractional ownership exit process and how long does it take? A: What is fractional ownership exit typically happens through platform secondary markets or periodic buyback programs. The process usually takes 30-90 days compared to 6-12 months for traditional real estate sales.

6. Q: What is fractional ownership risk compared to REITs? A: What is fractional ownership involves direct property exposure with concentrated risk but higher control, while REITs offer diversification but less control. Both are subject to real estate market cycles and regulatory changes.

7. Q: What is fractional ownership platform selection criteria for investors? A: When evaluating what is fractional ownership platforms, check SEBI registration, track record, property quality, fee transparency, technology features, and exit policies. Choose platforms with strong due diligence processes and investor protection measures.

You might be interested in reading this post as well:

DISCLAIMER: This content is for educational purposes only and should not be considered as personalized financial advice. Fractional ownership investments involve market risks and regulatory changes. Property values can fluctuate, and returns are not guaranteed. Always consult qualified financial advisors and conduct thorough due diligence before making investment decisions. Past performance does not indicate future result