If there’s one truth I’ve discovered, it’s this: the biggest obstacle to building wealth isn’t lack of income—it’s bad money habits. The good news? With a few smart changes, you can replace those habits with powerful ones that actually grow your rupees.

Why Do Bad Money Habits Stick?

Let’s be real: life in India as a young professional isn’t cheap. From rising living costs to EMIs, to the endless temptation of online shopping and cultural obligations (weddings, birthdays, gifting), it’s easy to feel like money just slips away.

I’ve been there—buying gadgets on impulse only to regret it when the credit card bill arrived. In fact, studies show that 40% of young Indians fall into debt due to impulsive spending. The problem is, these habits often feel “normal” until they stop us from saving and investing for the future.

9 Bad Money Habits (and How to Fix Them)

- Paying Yourself Last

Bad Money Habit: Paying bills, rent, and “fun money” first, and saving only if something’s left.

Fix: Pay yourself first—set aside at least 10% of your income the day your salary hits. Treat savings like rent: non-negotiable.

- Living on Bad Debt

Bad Habit: Credit card shopping, high-interest loans for luxuries.

Fix: Only borrow for assets (like education or business). If you use credit cards, clear the bill in full each month.

- No Emergency Buffer

Bad Habit: Skipping an emergency fund and panicking when medical or car expenses hit.

Fix: Build a cushion of 3–6 months’ expenses in a high-interest savings account.

- Lifestyle Inflation

Bad Habit: As income grows, expenses grow too—so savings never increase.

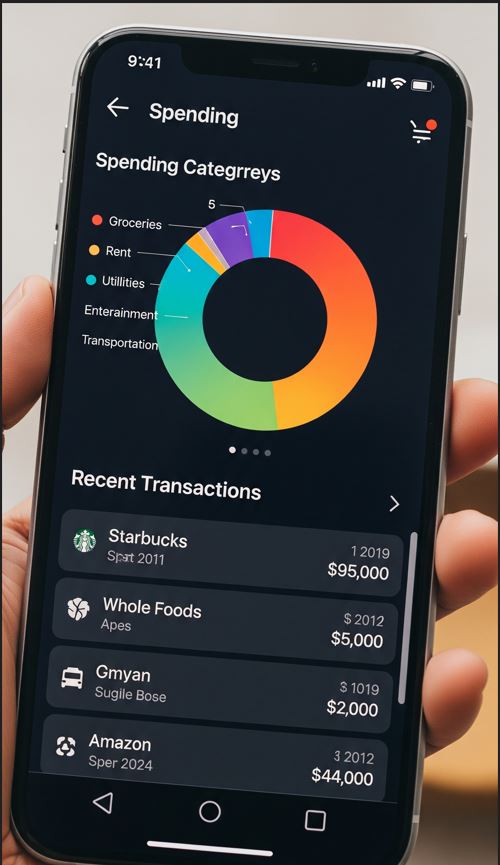

Fix: Track your spending. Apps like Money View or Walnut reveal hidden leaks (I once discovered I was spending ₹2,000/month just on café chai!).

- Costly Hobbies & Impulse Buys

Bad Habit: Shopping, gaming, or eating out eats into savings.

Fix: Cap your fun budget (say, ₹1,000/month). Channel extra energy into a side hustle instead.

- Saving Without Investing

Bad Habit: Hoarding money in a savings account, earning less than inflation.

Fix: Save 20%, but invest at least 10% in SIPs, mutual funds, or index funds.

- Paying More Taxes Than Necessary

Bad Habit: Ignoring tax-saving investments.

Fix: Use Section 80C (ELSS, PPF, NPS). I personally saved ₹30,000 last year just by planning.

- Delaying Investments

Bad Habit: Waiting “until you earn more” to invest.

Fix: Start small—₹1,000 SIPs add up. Time in the market beats timing the market.

- No Clear Financial Goals

Bad Habit: Wanting wealth but having no roadmap.

Fix: Write down your financial targets (e.g., ₹10 lakh in 10 years), track progress monthly, and adjust.

Real-Life Wins

Take Anil, a 27-year-old IT professional from Pune—by simply paying himself first (₹6,000/month), he built a ₹1.2 lakh emergency fund in 2 years. Or Priya, a 30-year-old marketer who ditched credit card debt and now invests ₹3,000/month in SIPs.

These aren’t “get-rich-quick” stories—they’re proof that small, consistent changes compound into financial freedom.

Action Plan: Start Today

- Here’s your 5-step starter plan:

- Auto-save ₹5,000 the day your salary hits.

- Track expenses for 7 days and cut one unnecessary habit.

- Start an emergency fund (aim for ₹25k this quarter).

- Open a ₹1,000 SIP today—it’s better to start small than wait.

- Pick one tax-saving option this month.

Final Thoughts

Breaking bad habits isn’t about perfection—it’s about progress. Even one small change can shift your financial future. Start with just one step from above, and let momentum carry you forward.

Thanks for reading! Which money habit are you tackling first? Share your thoughts below or drop us an email at contact@fintechrupee.com. And don’t forget to follow us on X (@FinTechRupee) for daily tips.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.