Credit Card for Low CIBIL Score India: 7 Best Picks for 2025

Does your heart sink a little when you check your CIBIL score? You are not alone. Many smart people like Rohan from Delhi or Priya from Bangalore face this. Maybe you missed a payment during a tough month, or you’re new to credit. It happens!

A low score can feel like a locked door, especially when you need a credit card for low CIBIL score India. But here’s the secret: that door isn’t locked, it just needs a different key.

This guide is that key. We will explore the 7 best credit card for low CIBIL score India options designed for those looking to rebuild their financial story. These cards are easier to get and can be your first step back to a healthy score. Let’s turn that worry into action!

What Is a Low CIBIL Score and Why It Matters for Credit Cards

Think of your CIBIL score as your financial report card. It is a 3-digit number (between 300 and 900) that tells banks how reliable you are with money.

A high score (above 750) makes getting loans and credit cards easy and cheap. A low score (below 650) makes it very tough. You might face rejections or higher fees.

But the goal is not just to get any card. It is to use the right credit card for low CIBIL score India wisely to improve your score. It is your tool for a financial comeback.

First, Why is a Good CIBIL Score So Important?

Your CIBIL score is a 3-digit number between 300 and 900. It’s like a financial report card that shows banks how good you are with credit. A score above 750 is great. A score below 650 is considered low.

A low score can happen because of missed payments, high existing debt, or simply having no credit history (like Rohan). Banks see this as risky, so they often say no to regular cards.

But that’s where a specialized credit card for low CIBIL score India comes in. These cards are designed to help people like Priya and Rohan get a second chance. Every credit card for low CIBIL score India focuses more on your current financial stability rather than past mistakes.

Top 7 Credit Cards for Low CIBIL Score India in 2025

These cards focus more on your income or security than your past mistakes. They are your gateway to rebuilding credit.

1. FD-Backed Credit Cards: The Safest Choice

This is the #1 way to get a credit card for low CIBIL score India. You open a Fixed Deposit (FD) with a bank, and they issue you a card with a limit of 80-90% of the FD amount.

How it helps: Zero risk for the bank = almost guaranteed approval for you.

Best for: Everyone, especially those starting out or rebuilding.

Top Picks: SBI Unnati Card, ICICI Bank Platinum Chip Card.

2. Secured Cards from Private Banks

Similar to FD-backed cards, these use your savings account balance as security. They often come with better rewards.

How it helps: Builds credit while giving you perks like cashback.

Best for: Those with some savings they can set aside.

Top Pick: IndusInd Bank Platinum Credit Card.

3. Small Finance Bank (SFB) Credit Cards

Banks like AU or Jana are more flexible than big banks. They look at your entire profile, not just the score.

How it helps: Great for salaried people with a stable job but a low score.

Best for: Salaried individuals with a bruised history.

Top Picks: AU Small Finance Bank Xcite Ace Card, Jana Small Finance Bank Classic Card.

4. Cards for Specific Professions

Some banks offer easier approvals to government employees, doctors, CAs, etc.

How it helps: Your job stability acts as a plus point.

Best for: Government employees and professionals.

Top Pick: Bank of Baroda Prime Credit Card.

5. Add-On Credit Cards

If a family member (parent/spouse) has a good card, they can get an add-on card for you.

How it helps: You can build your history by using this card responsibly.

Best for: Students or young adults living with family.

6. Pre-Approved Offers from Your Bank

Check your net banking app! Your bank may offer you a card based on your long-term relationship with them.

How it helps: Often bypasses hard CIBIL checks.

Best for: Existing customers with a solid account history.

7. Basic Entry-Level Cards

Big banks have simple, no-frills cards for newcomers. Having an account with them boosts your chances.

How it helps: Gets you into the ecosystem of a major bank.

Top Picks: SimplyCLICK from SBI.

How to Apply for a Credit Card for Low CIBIL Score India

Applying is simple, even with a low score. Follow these steps to successfully obtain your credit card for low CIBIL score India:

Check Your Score: Use CIBIL’s free report. Scores below 650 need secured cards.

Choose Secured Cards: FD-backed cards (e.g., SBI, ₹5,000 min) guarantee approval.

Gather Docs: Aadhaar, PAN, bank statement. Rohan used his ₹30,000 FD proof.

Apply Online/Offline: Use bank apps (IDFC, Jupiter) or visit branches. Takes 5–10 days.

Avoid Scams: Check RBI’s list of approved lenders at RBI’s portal.

Tip: Don’t apply to multiple banks at once—hard inquiries drop your score by 5–10 points.

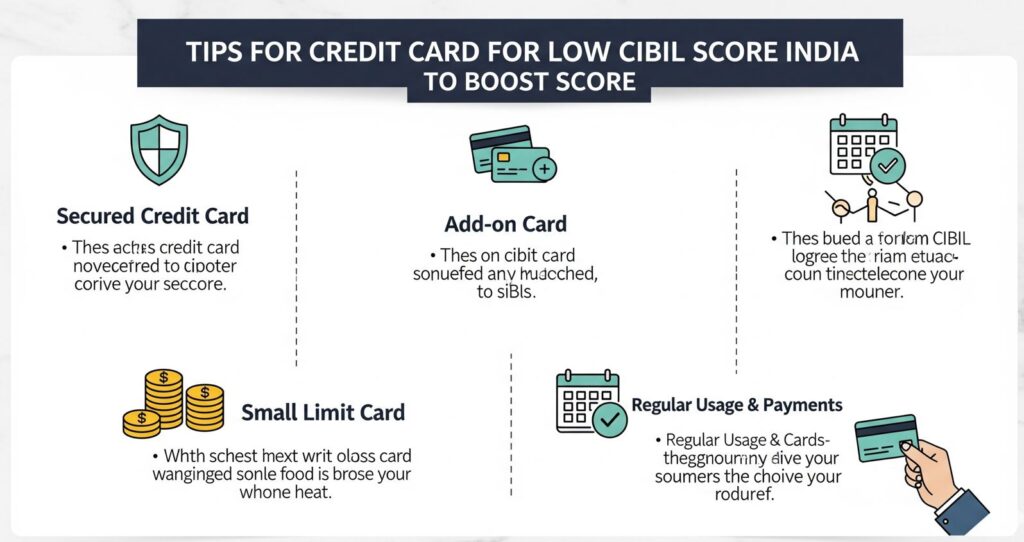

Tips to Use Your Credit Card and Boost Your CIBIL Score

Got your card? Great! Use it wisely to raise your score, like Priya did from 520 to 700 in 6 months.

Pay on Time: Even ₹500 late hurts. Set UPI autopay.

Keep Utilization Low: Use <30% of limit (e.g., ₹3,000 on ₹10,000 card).

Check Errors: Dispute wrong CIBIL entries annually.

Start Small: Secured cards build history fast.

Avoid New Loans: Wait 6 months before applying again

Frequently Asked Questions (FAQs)

Q1. How is a secured credit card different from a regular one?

A secured credit card is backed by your own money (a Fixed Deposit), while a regular card is not. A secured credit card for low CIBIL score India is perfect for people who want to build a credit history.

Q2. Is my Fixed Deposit safe if I get a credit card against it?

Yes, absolutely. Your FD remains safe and continues to earn interest. The bank only uses it to recover dues if you don’t pay your credit card bill.

Q3. What CIBIL score is considered too low?

Generally, a score below 650 is considered low. A score of 750 or above is ideal for getting any credit card for low CIBIL score India easily.

Q4. Can a student get a credit card?

Yes. A student over 18 can get an FD-backed credit card for low CIBIL score India, as no income proof is needed.

Q5. How long does it take to improve my CIBIL score?

With responsible use and timely payments, you can see a noticeable improvement in your CIBIL score within 6 to 12 months.

Q6. Do these cards have an annual fee?

Some cards are lifetime free, while others have an annual fee that can be waived if you meet a certain spending limit.

Conclusion: Your Financial Comeback Starts Now

A credit card for low CIBIL score India is your chance to build financial freedom, even with a score below 650. From IDFC’s WoW to SBI’s Advantage, 2025 offers easy options. Priya and Rohan started with ₹5,000 FDs and now manage EMIs smoothly.

Choose the right credit card for low CIBIL score India that matches your profile and avoid scams by sticking to RBI-approved banks. Use our tips to boost your score fast and transform your financial future. Ready to apply? What’s your CIBIL score, and which card excites you? Share in the comments—let’s chat!

References

RBI on Credit Card Regulations: https://www.rbi.org.in/

Paisabazaar Guide to Secured Cards: https://www.paisabazaar.com/credit-card/secured-credit-cards/

Moneycontrol on CIBIL Score: https://www.moneycontrol.com/credit-score/cibil-score

Disclaimer: The information provided in this article is for educational and informational purposes only. Credit card offers, eligibility, and terms may change based on the bank’s policies and your individual credit profile. Always verify details with the respective bank before applying. FintechRupee.com does not guarantee approval of any credit card for readers with a low CIBIL score. We are not responsible for any financial decisions made based on this article.

You might be interested in reading this post as well: